Accounting for Sales Return: Journal Entries and Example

Data:

3 Aprile 2023

It will help businesses if they have quality control in place, especially during production because this will ensure defect-free products. It is likewise important to be able to provide accurate product descriptions to set customer expectations right. Businesses should also venture into studying the latest product trends to keep up with the demands of the market. An open line of communication between businesses and customers will also be helpful so that customer concerns are properly taken care of before a sales return happens.

To Ensure One Vote Per Person, Please Include the Following Info

No further entry will be required as the receivable due from XYZ has been reversed. They bought one on the spot for $250 with their credit card, but they were so caught up in the hysteria brought on by the product’s next-level spaceship design that they forgot they were allergic to eggs. Upon receiving the machine and realizing how outrageously impractical their impulse buy was, they sent it back. The ABC cosmetics purchase product Y at $40 per piece and product Z at $20. Ask a question about your financial situation providing as much detail as possible. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Posting Return Inwards Book to Ledger

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when how payroll outsourcing works you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

Do you own a business?

Sales returns are considered a normal part of doing business because it is expected that there will be some sales return in the future due to the limited availability or imperfections of certain products. Therefore, sales returns should not cause too much concern for companies. However, it should alarm the business if the sales returns and allowances account is increasing because ultimately, this will result in a decrease in the company’s revenue and income. In this case one asset (accounts receivable) decreases as the money owed by the customer is cancelled, this reduction is balanced by the decrease in owners equity. The debit to the income statement for the sales return decreases the profit which decreases the retained earnings and therefore the owners equity in the business. MAHOGA Industries sold 1,000 units of a specific wood product to BLADE Industries for $6 per unit, on account.

Here, you’ll get a picture of what those terms mean, what those figures are used for, and how to record them on your income statement. So once this entry is posted, inventory will be increased, and the cost of goods sold will be derecognized. Once the buyer identifies these problems, the buyer will normally need to return the goods and then ask for returning cash or reducing the credit balance. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Bookkeeping

It is possible that a sales return will not be authorized until a later period than the one in which the original sale transaction was completed. If so, there will be an excessive amount of revenue recognized in the original reporting period, with the offsetting sales reduction appearing in a later reporting period. This overstates profits in the first period and understates profits in the later period. You can avoid this issue by recording a reserve for sales returns in the period in which the sale occurred. The company, in the interest of its commitment to customer service, offers a $20 partial refund. The company sends them the money, and its accountant debits $20 to its sales and allowances while crediting $20 to its accounts receivable.

- Hence, the value of goods returned must be deducted from the sale revenue.

- Otherwise, some customers will return goods with impunity, some of which may be damaged and which can therefore not be re-sold.

- This account is presented in the income statement as a deduction from “Sales” (or Gross Sales).

- It is possible that a sales return will not be authorized until a later period than the one in which the original sale transaction was completed.

This account is presented in the income statement as a deduction from “Sales” (or Gross Sales). A sales return is an adjustment to sales that arises from actual return by a customer of merchandise he/she previously bought from the business. It is commonly recorded under the account “Sales Returns and Allowances”. You can more closely control the amount of sales returns by requiring a sales return authorization number before your receiving department will accept a return. Otherwise, some customers will return goods with impunity, some of which may be damaged and which can therefore not be re-sold.

This is a particular concern when you are selling to retailers, since they may attempt to return pallet-loads of goods that they are not able to sell. Sales returns and allowance are the contra account to the sales revenues where the previously recognized sales need to be derecognized by recording into this account. Once sales are made, not only sale revenue and account receivable are affected by this transaction.

Processing a Return Inwards or Sales Return involves creating an invoice that details the return and specifies how it should be handled (refunds, replacements, exchanges, etc.). The invoice must then be approved by both parties before any action can take place. These are issued by retailers where they give discounts on certain items due to returned items. For instance, if a buyer were to purchase the aforementioned hard-boiled egg machine and notice only five out of its six egg-cooking modules are operational, they might ask for an allowance.

A Return Inwards or Sales Return is an agreement between a buyer and seller in which the buyer returns goods to the seller for a monetary refund, replacements, exchanges, or credit. Occasionally, goods sold to debtors on credit may be returned bookkeeping eugene by them for various reasons, viz, if the goods are defective, or in excess of their order, or are other than the ones ordered, etc. On 5th Feb 2020, the customer returned 5 pieces of product Y and 6 pieces of product Z to ABC cosmetics. So when the company’s warehouse physically receives the goods, the inventory account will be debited to increase the asset, and the cost of goods sold will be credited. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

(b) credits the personal account of each individual debtor with the amount of credit note issued to him, and inserts the appropriate folio number in the returns inwards book. In summary, sales returns are recorded at the amount the item was previously sold. This account is treated as a deduction from “Sales” in the financial statements.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Sales returns involve actual physical return of the merchandise with a corresponding refund or credit to the customer’s account. Sales allowance, on the other hand, happens when the customer agrees to accept the item with a reduction in its original selling price. Both incidents are adjustments to sales and are recorded under “Sales Returns and Allowances”. Normally sales returns and allowances are two different kinds of transactions. Still, the accounting treatment for both the transactions is the same, and mostly the same account is used to record both types of transactions. Accounting for sales return is mainly concerned with revising revenue and cost of goods sold previously recorded.

That’s why it’s vital to understand the items that come up on one, what they mean, and how to find and record them. Show the general entries to record sales and sales return in the books of ABC cosmetics. Sales allowances are recorded under the “Sales Returns and Allowances” account. All credit notes issued to customers are recorded in the Returns Inwards Book. On Feb 2, the journal entry to adjust inventory and record cost of goods sold account. The amount recorded as sales allowance is the amount of reduction in the original sales price.

Ultimo aggiornamento

13 Settembre 2024, 10:31

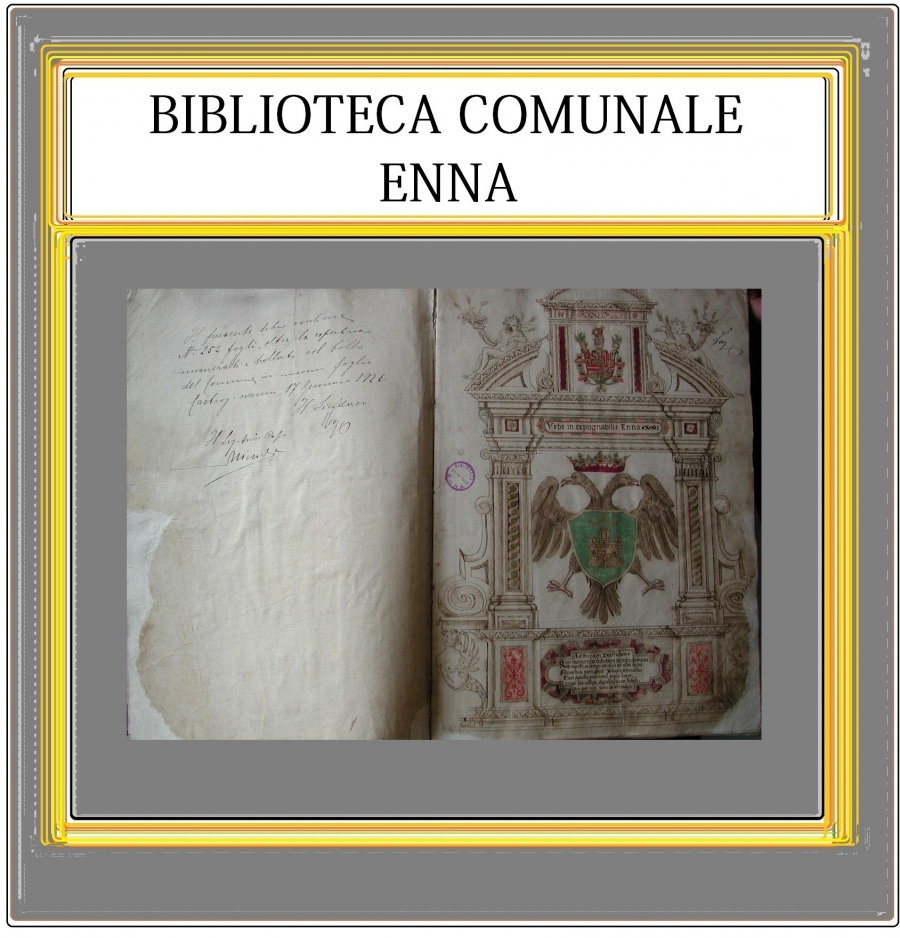

Biblioteca Comunale di Enna

Biblioteca Comunale di Enna