Reconcile an account in QuickBooks Online

Data:

23 Dicembre 2021

At the end, the difference between the account in QuickBooks and your bank statement should be US $ 0.00. To carry out a reconciliation, you will need to have your monthly bank or credit card statements on hand. These could, of course, be from multiple providers.

Can I Connect Wise to Shopify? Easy Integration Guide

To see all of your adjustments on the list, you can review a Previous Reconciliation report for the reconciliation you adjusted. This will show you cleared transactions and any changes made after the transaction that may not show in your discrepancies. QuickBooks will load the statements and facilitate a side-by-side comparison.

Step 4: Compare your bank statement and QuickBooks

It ensures that QuickBooks entries align with those in your bank and credit card account statements. Make sure you enter all transactions for the bank statement period you plan to reconcile. If there are transactions that haven’t cleared your bank yet and aren’t on your statement, wait to enter them. If they match, put a checkmark next to the amount.

- When you reconcile, you compare two related accounts make sure everything is accurate and matches.

- If you reconciled a transaction by accident, here’s how to unreconcile individual transactions.

- This forces your accounts to balance so you can finish your reconciliation.

- If you’re reconciling an account for the first time, review the opening balance.

- Once you’re done, you should see a difference of $0, which means your books are balanced.

Here’s how to enter an opening balance later on.

How does reconciliation work in QuickBooks?

If you added older transactions to QuickBooks that are dated before your opening balance, it may impact the account’s total. Here’s how to reconcile older transactions so everything stays balanced. Make sure you have the right dates and transactions. When you’re done reviewing your statement, you’ll know everything made it into QuickBooks.

It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks. If you need to make changes after you reconcile, start by reviewing a previous reconciliation report. If you reconciled a transaction by accident, here’s how to unreconcile individual transactions.

You should reconcile your bank and credit card accounts in QuickBooks frequently to make sure they match your real-life bank accounts. Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they match your bank and credit card statements. When you reconcile, you compare your bank statement to what’s in QuickBooks for a specific period of time. When you create a new account in QuickBooks, you pick a day to start tracking transactions. You enter the balance of your real-life bank account for whatever day you choose. We recommend setting the opening balance at the beginning of a bank statement.

With QuickBooks, there are ways to speed up or even automate the process. Reconciling does not need to be entirely manual these days. At the end of a reconciliation, you may see a small amount left over. After reviewing everything for accuracy, you’ll know if this discrepancy is a valid error. Once you’re done, you should see a difference of $0, which means your books are balanced.

If you don’t want to record a payment, select Cancel. Here’s how you can review all of your cleared transactions. Since all of your transaction info comes directly from your bank, reconciling should be a breeze. In adp vantage hcm® aca and benefits some cases, your accounts are already balanced. If you reconciled an account more than once, you likely already reviewed the opening balance.

Ultimo aggiornamento

12 Novembre 2024, 14:37

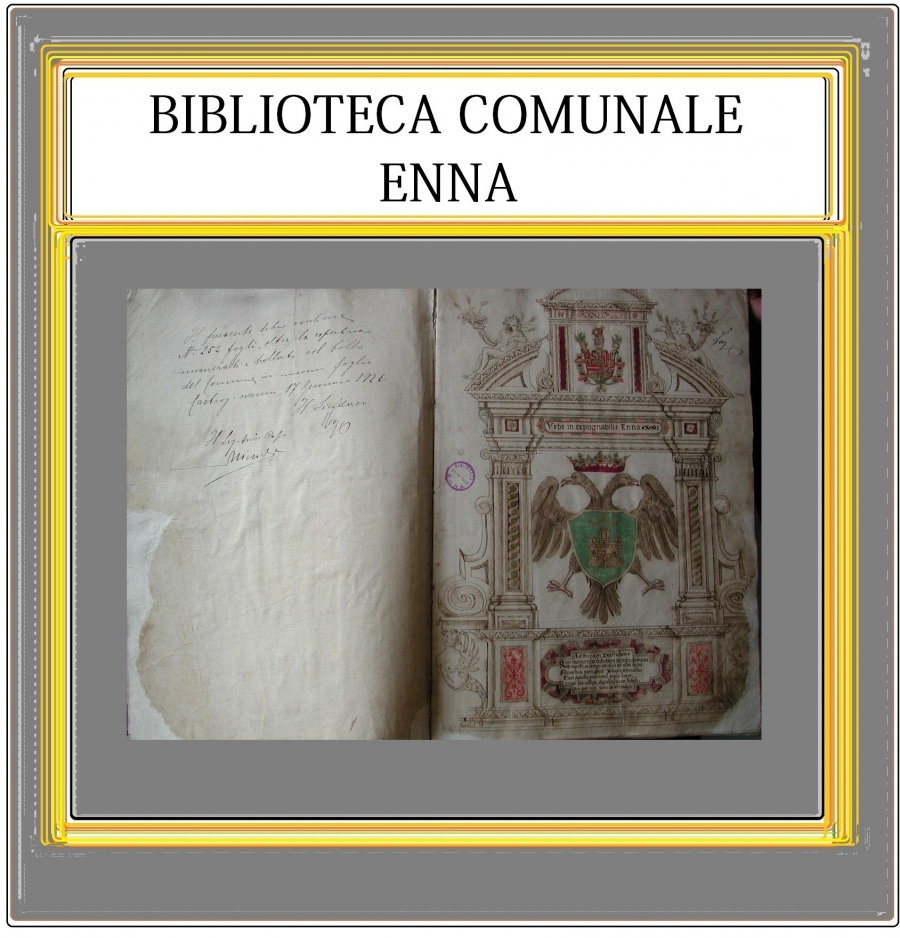

Biblioteca Comunale di Enna

Biblioteca Comunale di Enna