Current Ratio Formula, Calculation, and Example

Data:

21 Ottobre 2021

Since Charlie’s ratio is so low, it is unlikely that he will get approved for his loan. The current ratio provides the most information when it is used to compare companies of similar sizes within the same industry. Since assets and liabilities change over time, it is also helpful to calculate a company’s current ratio from year to year to analyze whether it shows a positive or negative trend. The current liabilities of Company A and Company B are also very different. Company A has more accounts payable, while Company B has a greater amount in short-term notes payable.

Dependence on Accounting Policies – Limitations of Using the Current Ratio

- As a result, the current ratio would fluctuate throughout the year for retailers and similar types of companies.

- A strong Current Ratio can instill confidence in potential investors, but it should be evaluated alongside other financial metrics and the company’s specific circumstances.

- A company can manipulate its current ratio by deferring payments on accounts payable.

- In fast-moving industries, a company’s warehouse of goods may quickly lose demand with consumers.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Here’s a look at both ratios, how to calculate them, and their key differences. Learn the skills you need for a career in finance with Forage’s free accounting virtual experience programs. This can be achieved through better forecasting and demand planning, more efficient production processes, or just-in-time inventory management. To give you an idea of sector ratios, we have picked up the US automobile sector.

The five major types of current assets are:

In contrast, a low current ratio may indicate that a company needs to improve its liquidity before pursuing growth opportunities. Investors and stakeholders can use the current ratio to make investment decisions. A company with a high current ratio may be considered a safer investment than one with a low current ratio, as it can better meet its short-term debt obligations. This means that Company B has $0.67 in current assets for every $1 in current liabilities, indicating that it may have difficulty paying its short-term debts and obligations. A very high current ratio could mean that a company has substantial assets to cover its liabilities. However, it could also mean that a business is not using its resources effectively.

Nature of the Business – How Does the Industry in Which a Company Operates Affect Its Current Ratio?

For example, if a company has $100,000 in current assets and $150,000 in current liabilities, then its current ratio is 0.6. The current ratio is 2.75 which means the company’s currents assets are 2.75 times more than its current liabilities. Because inventory levels vary widely across industries, in theory, this ratio should give us a better reading of a company’s liquidity than the current ratio.

On the other hand, a current ratio below 1 may indicate that a company may have difficulty paying its short-term debts and obligations. As a fundamental financial metric, the current ratio is essential in assessing a company’s short-term financial health. This current ratio guide will cover everything you need about the current ratio, including its definition, formula, and examples.

Note that sometimes, the current ratio is also known as the working capital ratio, so don’t be misled by the different names! Therefore, applicable to all measures of liquidity, solvency, and default risk, further financial due diligence is necessary to understand the real financial health of our hypothetical company. The range used to gauge the financial health of a company using the current ratio metric varies on the specific industry. Industries with predictable, recurring revenue, such as consumer goods, often have lower current ratios while cyclical industries, such as construction, have high current ratios. Current assets (also called short-term assets) are cash or any other asset that will be converted to cash within one year.

The current ratio helps investors and creditors understand the liquidity of a company and how easily that company will be able to pay off its current liabilities. So a current ratio of 4 would mean that the company has 4 times more current assets than current liabilities. Walmart’s short-term liquidity worsened from 2021 to 2022, though it appears to have almost enough current assets to pay off current debts.

It’s important to include other financial ratios in your analysis, including both the current ratio and the quick ratio, as well as others. More importantly, it’s critical to understand what areas of a company’s financials the ratios are excluding or including to understand what the ratio is telling you. It may be unfair to discount these resources, as a company may backward inhibitory learning in honeybees try to efficiently utilize its capital by tying money up in inventory to generate sales. It is important to note that a similar ratio, the quick ratio, also compares a company’s liquid assets to current liabilities. However, the quick ratio excludes prepaid expenses and inventory from the assets category because these can’t be liquified as easily as cash or stocks.

Ultimo aggiornamento

13 Novembre 2024, 13:33

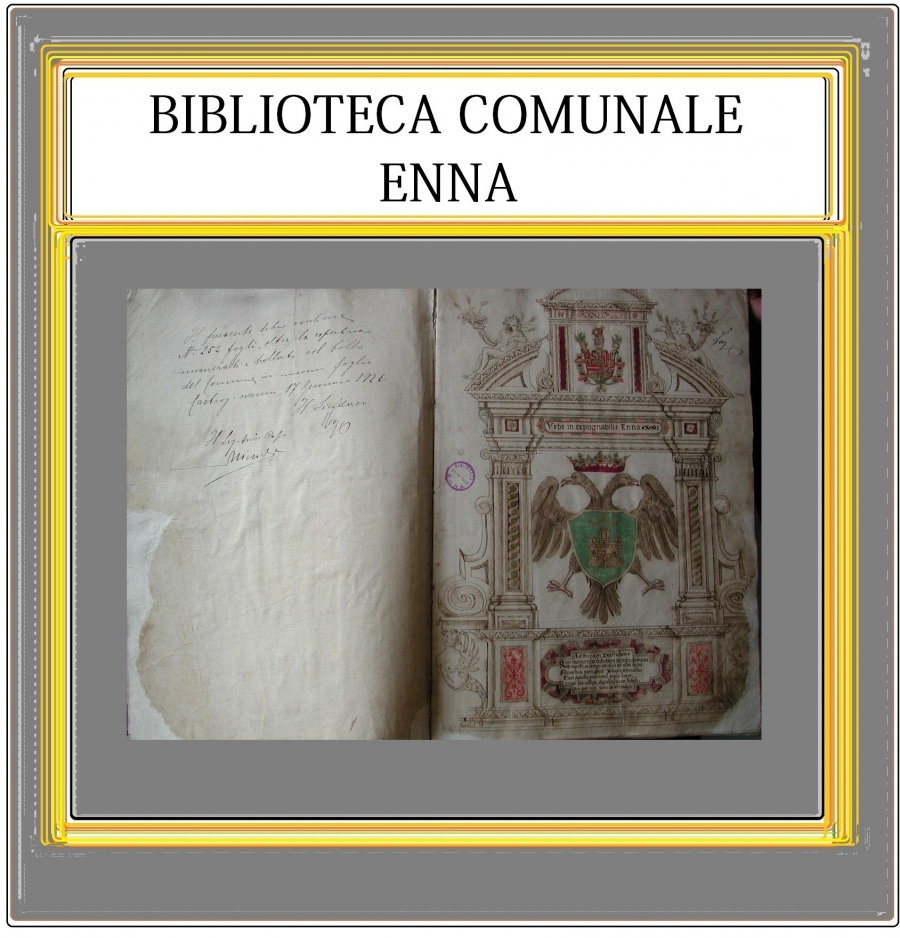

Biblioteca Comunale di Enna

Biblioteca Comunale di Enna