Free Cash Flow Statement Templates

Data:

3 Marzo 2023

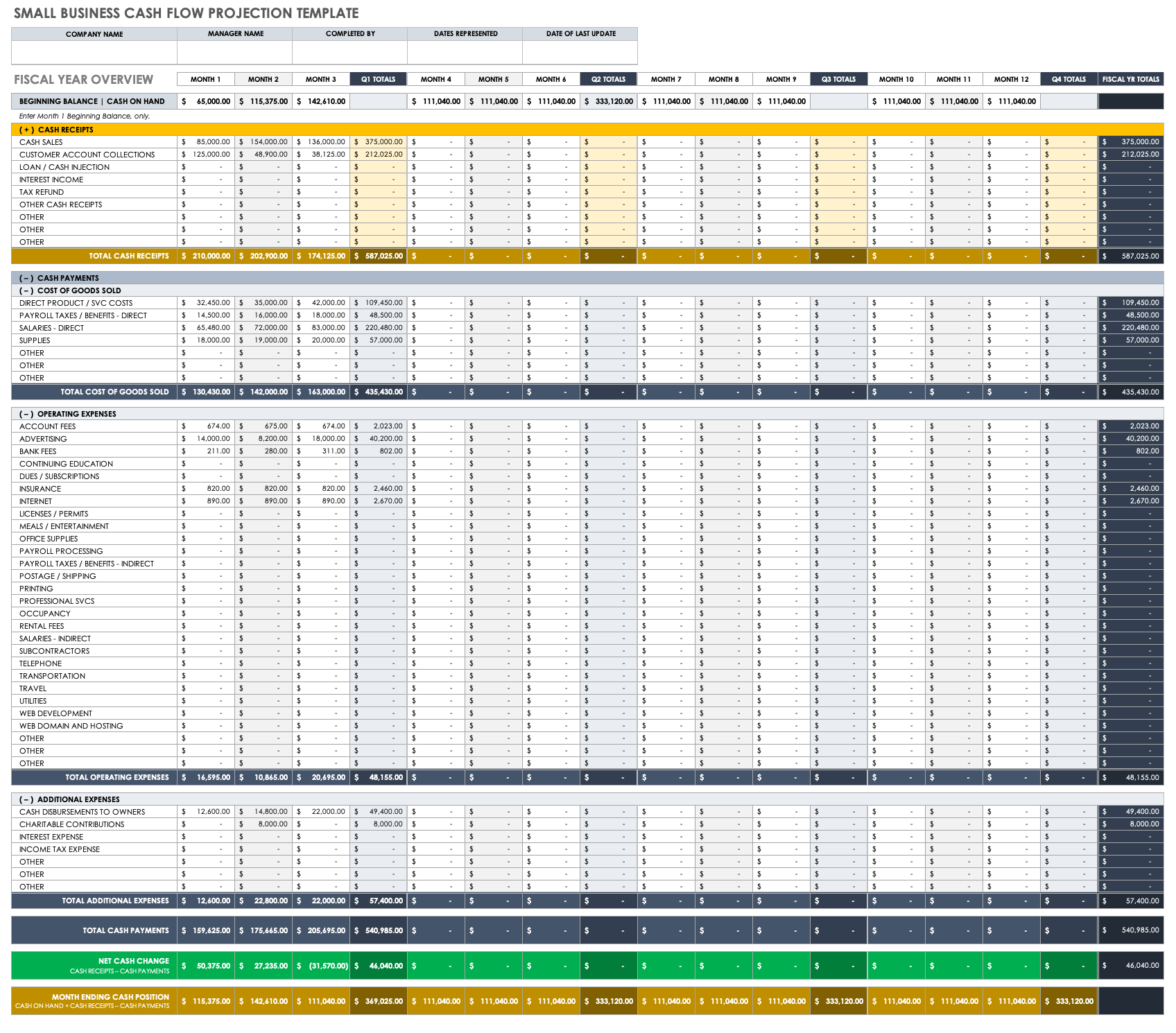

Throughout the year, take note of any large transactions that are non-cash items in the income statement, both gains and losses, as well as non-cash adjustments in the balance sheet. For the sale of fixed assets, list the book value of the asset in the investment activities section and any gain/loss in the operating activities. Remember to deduct gains from net income and add losses to it in the operating activities to avoid double counting. We’ve compiled the most useful free cash flow forecast templates, including those for small businesses, nonprofits, and personal cash flow forecasting, as well tips for performing a cash flow forecast.

- The “Monthly Cash Flow Template” by Vertex42 is a detailed Google Sheets template designed for comprehensive financial planning.

- If you included your Retirement Fund in the cash balance, then it wouldn’t make sense to include “Retirement Fund” as an Outflow.

- The Weekly Cash Flow Template is a powerful tool designed to help you track and analyze your cash inflows and outflows on a weekly basis.

- By combining your cash flow statement with a balance sheet, income statement, and other forms, you can manage cash flow and get a comprehensive understanding of business performance.

- Even though money market accounts usually have higher rates of return than most savings accounts, they also result in modest changes to the overall value of your assets.

- The template combines data from these files to generate expenses and income reports, as well as an automated cash flow dashboard.

Free Cash Flow Template for Google Sheets & Excel

Essentially, your entries show cash in and cash paid out each month for the time period that your cash flow statement covers. The Cash Flow Statement, or Statement of Cash Flows, summarizes a company’s inflow and outflow of cash, meaning where a business’s money came from (cash receipts) and where it went (cash paid). The cash flow statement is a standard financial statement used along with the balance sheet and income statement. The statement usually breaks down the cash flow into three categories including Operating, Investing and Financing activities. A simplified and less formal statement might only show cash in and cash out along with the beginning and ending cash for each period.

Considering Capital Expenditures in Cash Flow Statements

Revenue covers cash coming into the business from goods and services, and out of the business to wages, operating expenses and income tax payments. It will allow investors to analyze and compare cash flow statements more easily, enabling them to make more informed decisions. Both IFRS and GAAP allow the direct or the indirect method of calculating operating activities. Calculate the total change by adding together the operating, investing, and financing activities.

Getting Started withThis Template

Download a free cash flow statement template, learn how to prepare a statement, and discover the direct and indirect methods of cash flow statements. This guide will cover not only a cash flow statement template, but also how to prepare your cash flow statement, what to include in the three main sections, and how the direct and indirect methods differ. A cash flow statement is a document that shows the cash – including money from investments and convertible assets – moving in and out of a business, broken down by its source. This is used to make sure a company has enough cash to meet its day to day expenses, and to project how cash flows in future may shape up.

Build a stock portfolio spreadsheet, track your investments

Cash Flow Projections are even more important as they help you understand not only your current liquidity,… Read more about business cash flow, business accounting and Sheetgo’s templates in the articles below. This template covers a yearly overview of your cash flow split into months. This is great for those who are looking to simply keep track of their finances rather than an in-depth forecast of their net income. Spreadsheet-based workflow template to track payments, receipts and your cash balance.

It helps track and analyze both the income and expenses of your restaurant business. This Cash Flow Forecast Template from Live Flow has been meticulously designed to help businesses predict their cash inflows and outflows. Traditional financial statements – with categories of assets, liabilities, and profits and losses – are essential sources of information for small business owners. Cash Flow Statement is a financial report to provide relevant information about the cash receipts and disbursements the company has in particular accounting period. Created by professionals with years of experience in handling private and professional finances, these free excel templates have been downloaded times since 2006.

Our cash flow statement template can be customised to include the specific types of cash flow activities that apply to your company. Alternatively, you can easily create a cash flow statement based on an accounting system such as QuickBooks. Delayed payments to employees, suppliers, and other creditors can be massively detrimental to your business, so to understand your cash flow over a certain period of time, you need to create a cash flow statement.

A cash flow statement, also referred to as a statement of cash flows, shows the flow of funds to and from a business, organization, or individual. It is often prepared using the indirect method of accounting to calculate net cash flows. The statement is useful for analyzing business performance, making projections about future cash flows, influencing business planning, and informing important decisions.

The worksheet examines the change in each balance sheet account and relates it to any cash flow statement impacts. Once each line in the balance sheet is contemplated, the ingredients of the cash flow statement will be found! Moreover, the template includes the Net Cash Flow section to provide a clear the big list of small business tax deductions view of your business’s financial health. The Stock-Based Compensation and Common Stock Dividends Paid sections are essential for businesses that engage in such activities. The template covers aspects such as starting cash on hand, various incomes such as online and retail sales, and one-off incomes.

These articles and related content is the property of The Sage Group plc or its contractors or its licensors (“Sage”). Please do not copy, reproduce, modify, distribute or disburse without express consent from Sage.These articles and related content is provided as a general guidance for informational purposes only. These articles and related content is not a substitute for the guidance of a lawyer (and especially for questions related to GDPR), tax, or compliance professional. When in doubt, please consult your lawyer tax, or compliance professional for counsel.

The term ‘cash’ refers to both cash and cash equivalents, which are assets readily convertible to cash. This financial statement provides relevant information to assess a business’s liquidity, quality of earnings, and solvency. Now we’ll show you how to make your own cash flow statement template in Google Sheets. The simple layout makes it easy to use and provides a financial overview at a glance.

Ultimo aggiornamento

8 Novembre 2024, 22:24

Biblioteca Comunale di Enna

Biblioteca Comunale di Enna