How does crypto exchange work? Get Started with Bitcoin com

Data:

17 Ottobre 2024

Content

However, DEXs can suit those prioritizing privacy and control over their funds. Cryptocurrency trading has gained immense popularity, offering high potential returns for investors. To enter the world of crypto trading, one must navigate the landscape of exchanges. Centralized exchanges like FTX often lack transparency, leaving users in the dark about how trades are executed or https://www.xcritical.com/ how funds are managed behind the scenes. High-profile incidents in the past, such as the Mt. Gox hack, have resulted in significant losses for users.

What are the main differences between centralized and decentralized exchanges?

The operations of these exchanges may vary significantly in terms of user interface, trading fees, security measures, and the range of available trading pairs. The year 2022 marked some noticeable setbacks for the reputation of centralized exchanges. As a matter of fact, it is inevitable to worry about CEXs owing to the collapse of FTX, one of the renowned centralized crypto exchanges. The decisions for choosing an effective platform from a centralized centralised exchange crypto exchanges list could waver in response to the unprecedented downturn for centralized exchanges. Therefore, users are likely to consider DEXs or decentralized exchanges as an alternative to centralized exchanges. Most important of all, the growth of the DeFi movement serves viable implications for the adoption of decentralized exchanges.

They Offer Protection Against Scandals

While some exchanges compete on low fees, others may charge higher rates for premium features. Decentralized exchanges are often thought of as a “trustless” environment, functioning as peer-to-peer exchanges. Assets are never held by an escrow service, and transactions are done entirely based on smart contracts and atomic swaps and only between users. The most obvious difference between centralized and decentralized exchanges is ownership.

How do centralized and decentralized exchanges differ in security?

The information or opinions provided should not be taken as specific advice on the merits of any investment decision. We will not be responsible for any losses incurred by a client as a result of decisions made based on any information provided. Centralised and decentralised exchanges both exist to enable users to trade digital assets.

Unspent Transaction Output (UTXO)

As governments and regulatory bodies around the world better understand and define the crypto space, clearer regulations are expected to emerge. This could lead to greater investor confidence and more substantial investments from both retail and institutional investors. For more insights on the importance of centralized exchanges in cryptocurrency trading, you can read The Crucial Role of Centralized Exchanges in Cryptocurrency Trading. As cryptocurrencies gain mainstream acceptance, the regulatory landscape is expected to evolve, significantly impacting centralized exchanges. Governments and financial authorities around the world are beginning to recognize the need for formal regulations to manage the complexities of cryptocurrency trading. This includes the establishment of clearer guidelines on anti-money laundering (AML) practices, know your customer (KYC) procedures, and the overall operation of exchanges.

A decentralized exchange is a peer-to-peer marketplace where you may trade cryptocurrencies directly with other users, bypassing the middlemen. Centralized exchanges represent a single point of failure in the cryptocurrency ecosystem. If a centralized exchange experiences downtime or operational issues, users may be unable to access their funds or execute trades, leading to potential financial losses. A major defining feature of a decentralized exchange is there is no central governing authority to facilitate trading of assets. By making use of a widely distributed network of users that are connected by the blockchain, DEXs operate without a central authority. Centralized exchanges are very popular among people who want to sell or trade cryptos.

A centralized crypto exchange is run by a third party, monitoring and facilitating transactions and securing assets. The exchange provides the necessary infrastructure for market participants to conduct transactions. These transactions are generally settled off-chain on a centralized server the exchange operates.

One of the significant highlights in favour of CEXs refers to the advantage of regulations. The regulatory aspect of centralized exchanges ensures better safety and transparency by ensuring that the exchange operates within the limits of the law. At the same time, it is also important to note that centralized exchanges offer better performance in comparison to DEXs. Market makers in CEXs offer liquidity to ensure an easier and more prompt exchange of assets. However, decentralized exchanges shine in terms of cheaper fees and anonymity of users.

This necessitates robust security measures such as two-factor authentication, encryption, and regular security audits to protect user assets. Centralized exchanges are often preferred by users looking to trade large volumes due to their liquidity and the ability to execute orders quickly. They also typically provide a more user-friendly interface and customer support, making them accessible to newcomers in the cryptocurrency world.

- Unlike a CEX, a DEX does not support custodial infrastructures where the exchange holds all the wallet’s private keys; rather, it allows you to be in control of your funds.

- Centralised exchanges that support digital assets receive orders from individual or institutional clients and they typically match buy and sell orders that have the same price.

- This centralized control contradicts the ethos of decentralization that underpins cryptocurrencies.

- A major defining feature of a decentralized exchange is there is no central governing authority to facilitate trading of assets.

- Users can easily deposit fiat currency through various methods, including bank transfers and credit cards, and start trading almost immediately.

- Centralized exchanges (CEXs) operate similarly to traditional financial exchanges, where a central authority manages the platform.

- Most of the popular cryptocurrencies have users worldwide, and they are decentralized assets.

In addition, Kraken also supports a broad range of cryptocurrencies alongside offering a robust rewards program. However, Kraken is a suitable option for intermediate and expert cryptocurrency traders. Another striking aspect which determines the usability of a Centralized Crypto Exchange (CEX) is security.

They act as an intermediary, attempting to provide a safe way to connect users to each other and as a way to exchange fiat and cryptocurrencies. And understanding the pros and cons of centralized vs decentralized exchanges will definitely help in your day trading crypto knowledge. Most CEXs work with market makers to ensure there are enough digital assets to settle trades on their platforms.

Centralized exchanges (CEXs) operate similarly to traditional financial exchanges, where a central authority manages the platform. This setup facilitates higher trading volumes and faster transactions, making it more suitable for traders looking for liquidity and quick trade execution. Major examples include Binance and Coinbase, which are known for their robust security measures, user-friendly interfaces, and a wide range of available cryptocurrencies and trading pairs. Coinbase is one of the most prominent examples of a centralized cryptocurrency exchange. Founded in 2012, it has grown to become a leading platform in the crypto space, known for its user-friendly interface and robust security measures. Coinbase offers a wide range of services, including cryptocurrency trading, a wallet service, and merchant solutions, making it a comprehensive platform for both novice and experienced users.

This might include identity verification processes and two-factor authentication. Each platform has its own limits and processing times, which can be a crucial factor for traders needing quick access to their funds after selling their assets. For more detailed information on how these mechanisms work, you can visit sites like Investopedia or specific exchange FAQs. Wallet infrastructure is integral to the operation of a centralized exchange.

In the past, some centralized exchanges have worked hard to recover user losses with varying results. On the other hand, some centralized exchanges collapsed as a result of security vulnerabilities. Once matched, trades are executed, and funds are transferred between users’ wallets, with the exchange deducting fees as applicable. Execution and settlement processes occur swiftly, ensuring timely completion of transactions and accurate accounting of assets.

You can choose centralized exchanges for purchasing or selling crypto assets with proper knowledge about cryptocurrencies. On the other hand, every entry in a centralized crypto exchange list does not serve as the best option for all users. The best course of action for choosing centralized exchanges would focus on exchanges with good reputations. Here is an outline of the popular centralized crypto exchanges you can find now.

Additionally, for a deeper understanding of the role of such platforms, consider reading about The Crucial Role of Centralized Exchanges in Cryptocurrency Trading. Reach out to our team to discuss how we enable leading exchanges to access to payment rails, and multi-currency transaction business solutions. Since DEXs are built on-chain, they are limited to offering support for tokens that are native to the chain they run on. For example, Ethereum-based DEXs will support ERC-20 tokens, but a trader may not be able to swap from native Bitcoin to Ether easily. Automated Market Makers are algorithms that set the price of an asset based on a mathematical formula and the supply of tokens available in a DEXs liquidity pools.

They are the most common type of crypto exchanges and offer several advantages. Hybrid exchanges in the cryptocurrency world aim to combine the best features of both centralized and decentralized platforms, offering a balanced approach to trading digital assets. These exchanges provide the speed and user-friendly experience of centralized exchanges while maintaining the security and anonymity features of decentralized exchanges. The differences between DEXs and centralized crypto exchange platforms show that both of them have advantages and setbacks.

The level of verification may vary depending on the user’s intended trading volume or the regulatory requirements of the jurisdiction in which the exchange operates. To sum up, centralized exchanges simplify things and help you more, while decentralized exchanges are for those who want more control and less outside interference in their trading. Decentralized exchanges use blockchain and smart contracts to make trades happen. As a conclusion, below is a TLDR overview of the main differences between centralized and decentralized exchanges. Decentralised exchanges run as smart contracts on public blockchains like Ethereum or Solana.

Each exchange must evaluate the regulatory environment of its target markets and determine the best approach to licensing based on its operational strategy and business model. Decentralized exchanges are steadily gaining ground, particularly within the decentralized finance ecosystem. A centralized exchange (also known as a centralized cryptocurrency exchange or CEX) is a platform that enables users to trade, deposit, and withdraw cryptocurrencies.

Ultimo aggiornamento

11 Novembre 2024, 18:01

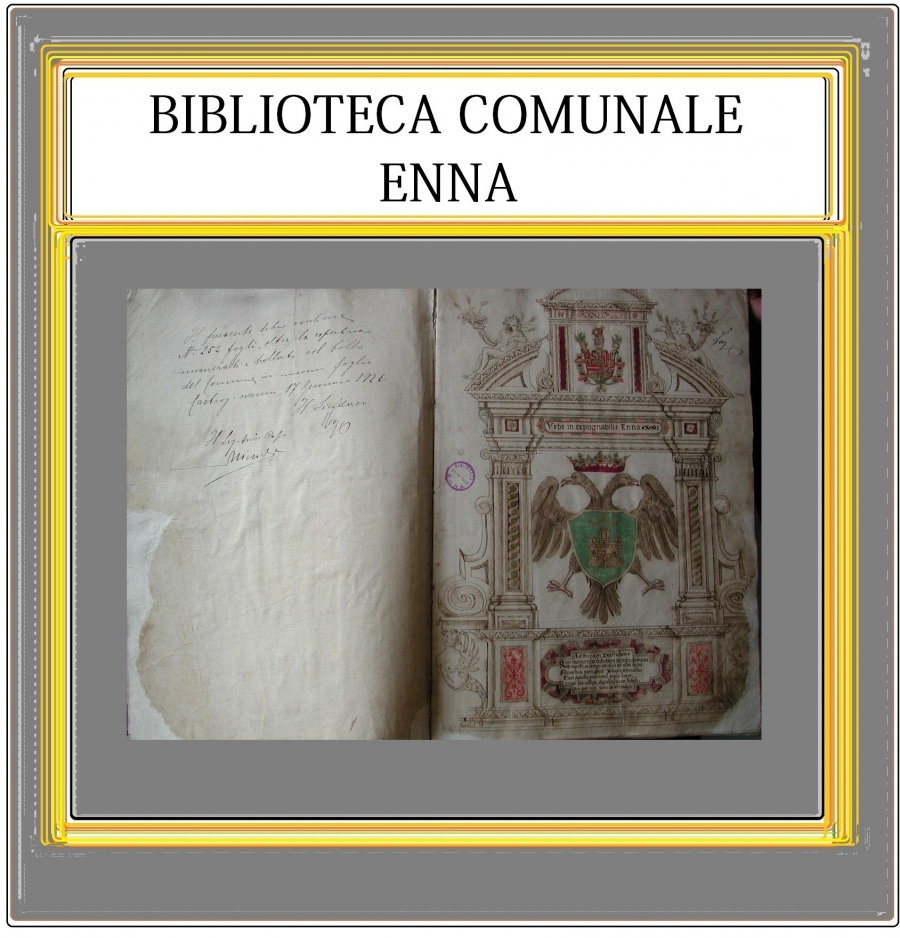

Biblioteca Comunale di Enna

Biblioteca Comunale di Enna