Par Value vs Market Value: What’s the Difference?

Data:

24 Febbraio 2021

The remainder of the purchase price is debited to the retained earnings account. If the treasury stock is resold at a later date, offset the sale price against the treasury stock account, and credit any sales exceeding the repurchase cost to the additional paid-in capital account. Treasury stock refers to shares that companies buy back, thereby decreasing the number of shares outstanding.

- The Additional Paid-in Capital account is credited for the economic gain because current accounting and tax rules do not allow corporations to record a profit and, in this way, increase retained earnings by dealing in its own stock.

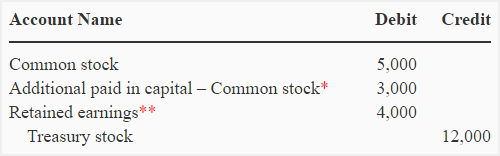

- Under the par value method, at the time of share repurchase, the treasury stock account is debited, to decrease total shareholder’s equity, in the amount of the par value of the shares being repurchased.

- This is because no other paid-in capital account exists for no-par-value stock.

- The difference between the actual price paid and the par or stated value of treasury shares is recorded in an account known as gain or loss on purchase and sale of stock.

The Cost Method

When management does not intend to reissue shares but also does not desire to formally retire them, it is recommended that the par value method be applied. After dividing the net income of $200,000 by the diluted share count of 105,000, we arrive at a diluted earnings per share (EPS) of $1.90. However, it may indirectly benefit shareholders by potentially boosting EPS and share prices. Under the cash method, the treasury account would be debited for $50,000 and cash credited for $50,000. Corporations use buybacks to reduce the amount of shares in circulation, thereby boosting their stock price. In 2023, the top 500 companies spent nearly $800 billion to repurchase their own shares.

Why You Can Trust Finance Strategists

However, this excess amount cannot be used to increase the retained earnings balance even if the reacquisition of the shares were set off against retained earnings. The issued shares are treated as if they are being issued for the first time with the treasury stock account being credited instead of the share capital account. The price paid in excess of the amount accounted for as the cost of the treasury shares shall be attributed to the other elements of the transaction and accounted for according to their substance. If no stated or unstated consideration in addition to the capital stock can be identified, the entire purchase price shall be accounted for as the cost of treasury shares. The cost method of accounting values treasury stock according to the price the company paid to repurchase the shares, as opposed to the par value. Using this method, the cost of the treasury stock is listed in the stockholders’ equity portion of the balance sheet.

Our Team Will Connect You With a Vetted, Trusted Professional

Treasury stock is a contra equity account recorded in the shareholders’ equity section of the balance sheet. Because treasury stock represents the number of shares repurchased from the open market, it reduces shareholders’ equity by the amount paid for the stock. The total value of assets reported on a company’s balance sheet only reflects the cost of the assets at the time of the transaction.

This can make the stock more attractive to investors and help to drive up the share price. Additionally, buying back shares can be a way for companies to return money to shareholders, and it can also help to reduce the company’s state income tax overall financial risk. In terms of the steps involved in the TSM, first, the number of in-the-money options and other dilutive securities are summed up, and that figure is then added to the number of basic shares outstanding.

Create a Free Account and Ask Any Financial Question

By contrast, under the par value method, share buybacks are recorded by debiting the treasury stock account by the shares’ total par value. If the board elects to retire the shares, the common stock and APIC would be debited, while the treasury stock account would be credited. There are a few potential benefits for companies that buy back their own shares. First, it can help to boost the value of the remaining shares by reducing the number of outstanding shares.

Each share of the company’s common stock is selling for $25 on the open market on May 1, the date that Duratech purchases the stock. Duratech will pay the market price of the stock at $25 per share times the 800 shares it purchased, for a total cost of $20,000. The following journal entry is recorded for the purchase of the treasury stock under the cost method. When shares are repurchased, the treasury stock account is debited to decrease total shareholders’ equity.

Note that only the securities deemed “in-the-money” are assumed to have been exercised, therefore those “out-of-the-money” are not included in the new share count. Furthermore, the EPS formula divides the net income of a company by its share count, which can be either on a basic or diluted basis. Besides options, other examples of dilutive securities include warrants and restricted stock units (RSUs). The exclusion of these types of securities into common equity would mistakenly inflate the earnings per share (EPS) figure. The Treasury Stock Method (TSM) is used to compute the net new number of shares from potentially dilutive securities.

Ultimo aggiornamento

11 Novembre 2024, 14:01

Biblioteca Comunale di Enna

Biblioteca Comunale di Enna